March 2025 Issue

- Aliza Divine Torres

- May 21, 2025

- 2 min read

Updated: Jun 27, 2025

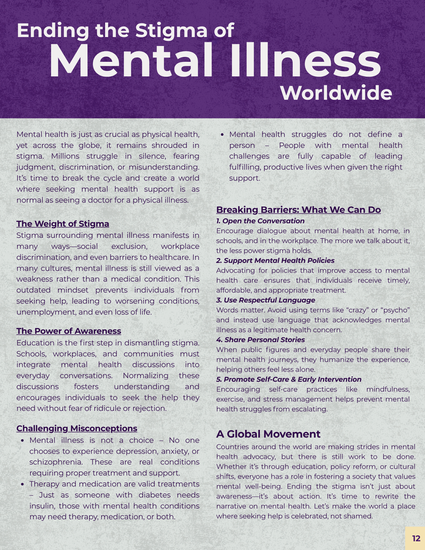

Ending the Stigma of Mental Illness Worldwide

Scroll down below to enjoy and download the complete edition of our newsletter.

Financial Health Check: Are You Making These Money Mistakes?

Achieving financial stability isn’t just about earning more—it’s about managing what you already have. Many individuals unknowingly make money mistakes that sabotage their wealth-building potential. Are you guilty of any of these common financial missteps?

1. Neglecting a Budget

You wouldn’t take a road trip without a map, so why navigate your finances blindly? A well-structured budget ensures that you’re not overspending and that every dollar has a purpose.

2. Living Paycheck to Paycheck

If your income barely covers your expenses, you’re in a vulnerable financial position. Strive to build an emergency fund to cover at least three to six months’ worth of expenses.

3. Failing to Invest Early

Time is your greatest ally in wealth-building. Thanks to compound interest, even small investments made early can grow significantly over time. Delaying investments means missing out on exponential growth.

4. Ignoring Debt Repayment

Carrying high-interest debt—especially credit card debt—can cripple your financial progress. Focus on paying off high-interest obligations first, using strategies like the avalanche or snowball method.

5. Not Having Multiple Income Streams

Relying solely on one income source puts you at risk. Consider side hustles, investments, or passive income streams to increase financial security.

6. Overspending on Lifestyle Inflation

As income increases, many people upgrade their lifestyle instead of saving or investing. This phenomenon, known as lifestyle inflation, can keep you in a perpetual cycle of financial stress.

7. Failing to Save for Retirement

The earlier you start saving for retirement, the better. Maximize contributions to employer-sponsored plans, IRAs, or other retirement accounts to secure your future.

8. Avoiding Financial Education

Lack of financial literacy can lead to poor decisions. Take time to educate yourself about investments, taxes, and wealth-building strategies.

9. Not Having Proper Insurance Coverage

Unexpected events—medical emergencies, accidents, or job loss—can drain your finances. Adequate health, life, and property insurance are essential for financial protection.

10. Skipping Regular Financial Checkups

Your financial situation evolves, and so should your strategies. Regularly review your budget, investments, and financial goals to stay on track.

Take Action Today

Avoiding these money mistakes can significantly improve your financial well-being. Conduct a personal financial audit, make necessary adjustments, and seek professional advice if needed. Your financial future depends on the decisions you make today.

Download the full newsletter here ↓